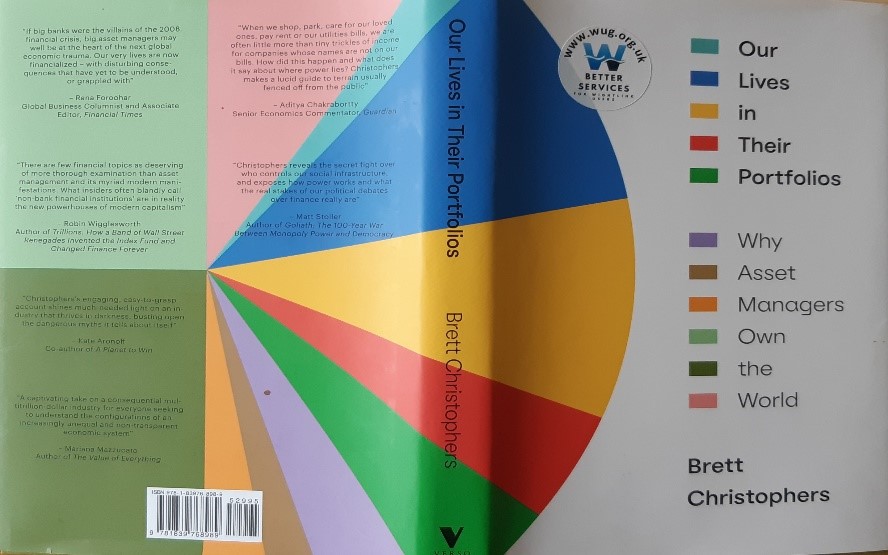

Our Lives in Their Portfolios: Why Asset Managers Own the World

By Professor Brett Christophers

The Wightlink ferry company providing services to and from the Isle of Wight has been controlled by asset-management firms (“asset managers”) for most of the past three decades.

What are such asset managers?

Simply stated, they are investment institutions that principally invest others’ capital, earning fees for doing so.

Traditionally, they were a peripheral part of the economy, and distant from most people’s lives, investing exclusively in financial assets like company shares. Today, however, they manage around $100 trillion of customer capital globally, which they invest not just in financial assets but also in “real” assets that ordinary people rely upon in everyday life – including transportation infrastructure, such as Wightlink.

Wightlink’s own odyssey with asset managers began in 1995, when its then owner – the since-liquidated Sea Containers Ltd. – sold it to the asset-management firm Cinven. In 2001, Cinven sold Wightlink to its management team: the beginning of a solitary, four-year period since the mid-1990s when asset managers were not in control. Wightlink returned to assetmanager ownership in 2005, when it was bought by the world’s largest infrastructure-focused manager, Australia’s Macquarie. A decade later, Macquarie sold out, to another asset manager, Balfour Beatty Infrastructure Partners, subsequently renamed Basalt Infrastructure Partners. Basalt today shares control with yet another asset manager, Canada’s Fiera, to which it sold a 50 percent stake in 2019.

What asset-manager owners of essential infrastructure actually do, how, and with what consequences for society, has long been hidden from public view. “What we do is behind the scenes”, the head of one leading such firm once said to the Financial Times. “Nobody knows we’re there”.

This book – Our Lives in Their Portfolios: Why Asset Managers Own the World – aims to break the silence and to bring the operations and impacts of firms like Macquarie into full view. It shows that asset-manager ownership of essential physical infrastructures in transportation, energy, housing and other sectors generally results in deleterious outcomes, not least for the users of such infrastructure. Usage charges escalate rapidly; infrastructure maintenance and upgrades wane.

At the same time, the asset managers themselves extract egregious riches, while using financial wizardry to minimise taxes paid. I hope you find the book interesting and informative.

Brett Christophers

Uppsala University June 2023